Leading banks under pressure from slowing economic growth

Major Chinese lenders' third-quarter reports show that they are still under pressure from narrowing profit margins, disappointing non-interest income and bad loans.

The latest report card filed by China Citic Bank showed a 14.6 percent year-on-year decline in net profit to 7.9 billion yuan ($1.26 billion) in the three months to Sept 30.

Citic attributed its poor performance to allocation of 4 billion yuan as provision for potential bad loans, and the narrowing of the net interest margin to an average of 2.68 percent in the reporting period from 2.79 percent in the second quarter and 3.01 percent in the first quarter.

The squeeze on interest margins was triggered by the central bank's move in July to further liberalize lending rates by pushing the ceiling at which banks can set their lending rates below the benchmark from 20 to 30 percent in June.

This has touched off a rates war as banks fiercely compete to attract borrowers as loan demand was curtailed by a slowdown in economic growth.

Analysts said that after several rounds of benchmark interest rate cuts, commercial bank profit growth in China has been affected in the past two quarters, and may drop further by the end of the year.

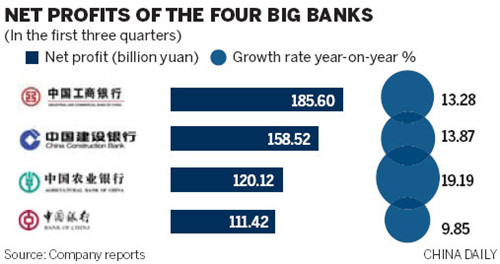

All of the four largest State-owned lenders, which had released third-quarter reports by Tuesday, said they secured net profit growth in the quarter. But some are facing growing pressure from bad debts amid slowing economic growth.

Industrial and Commercial Bank of China Ltd, the world's largest bank by market value, on Tuesday reported 15 percent year-on-year growth in the third quarter, with net profit rising to 62.44 billion yuan between July and September.

ICBC's net interest margin, which measures profitability on loans and other interest-bearing assets, "rebounded" in the first nine months, the bank said in a statement, without providing the figure.

Meanwhile, the measure expanded at the bank's three largest competitors.

Bank of China Ltd last week reported a better-than-estimated 17 percent increase in third-quarter profit, while Agricultural Bank of China Ltd posted a 16 percent gain, both exceeding analysts' estimates. China Construction Bank Corp's 12.4 percent increase was in line with estimates.

Bank of Communications Co, the nation's fifth-largest lender, said on Tuesday its third-quarter profit rose 12 percent to 13.4 billion yuan, compared with an average analysts' estimate of 13.9 billion yuan. China Minsheng Banking Corp posted a 31 percent increase in quarterly profit to 9.8 billion yuan, beating an estimate of 8.8 billion yuan.

ICBC, led by Chairman Jiang Jianqing, extended 848.9 billion yuan of new loans in the first nine months, taking the total to 8.64 trillion yuan.

Non-performing loans fell to 74.8 billion yuan as of Sept 30, compared with 75.1 billion yuan three months earlier, as some borrowers struggle to make payments amid slowing economic growth.

The bank set aside 5.7 billion yuan for soured loans in the third quarter, 25 percent less than a year earlier.

According to the most recent figures from National Bureau of Statistics, Chinese industrial companies' profits dropped 6.2 percent in August from a year earlier, the largest decline this year and the fifth straight monthly deceleration, before gaining 7.8 percent in September, Profits at steel producers and processors tumbled 81 percent during the first eight months to 19.3 billion yuan on overcapacity and sluggish demand from builders and automakers.

ICBC's net interest income rose 16 percent to 107.3 billion yuan in the third quarter, while income from fee-based services such as credit cards increased 1.5 percent to 24.9 billion yuan.

"It's true that the whole banking sector is facing increasing pressure to secure profit growth, as net interest margins continue to fall and fee income declines due to tightened regulation," said Wang Kang, general manager for financial planning at China Citic Bank.

Wang said commercial banks' profit growth would show an obvious drop by the year end, while bad loans would continue to rise as some small and medium-sized enterprises continue to face great challenges amid the slowdown in economic growth and have to default.

"We're fully aware that the trend will continue. One good thing is that the factors that dragged down net interest margins seem to have weakened, although it's still difficult to tell when margins will start to pick up again," he said.

The government has accelerated approval of investment projects, lowered interest rates and boosted tax support for exporters. At the same time, the authorities have refrained from further easing monetary policy since rate cuts in June and July and a May reduction in banks' reserve requirements.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.