New home sales in China's major cities surged in March from a month earlier, and more cities saw a monthly rise in new home prices, official data showed over the weekend.

Among 70 large and medium-sized Chinese cities monitored by the National Bureau of Statistics (NBS), 12 saw a month-on-month rise in new home prices in March, up from two in February, while 50 of them saw new home prices drop, down from 66 cities a month ago, data from the NBS showed Saturday.

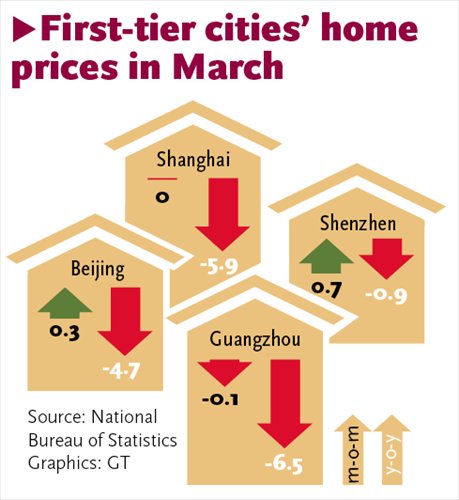

In March, new home prices in Beijing rose 0.3 percent from a month earlier, reversing a declining trend over the past eight months, according to the NBS.

On a yearly basis, new home prices in the 70 cities continued to drop in March. But Liu Jianwei, a senior statistician with the NBS, said the extent of the decline in home prices will gradually decrease, according to a statement posted Saturday on the bureau's website.

New home sales surged by 65.9 percent from a month earlier to 217,000 units in March, partly because February sales were affected by the week-long Spring Festival holidays, Liu said.

Liu said home sales will continue to rise, boosted by a batch of supportive property policies announced on March 30, which include relaxing mortgage rules for second-home buyers and a tax exemption for second-hand home transactions.

The People's Bank of China, the central bank, announced Sunday that it will cut banks' reserve requirement ratio by 1 percentage point starting from Monday, a move that analysts said has also sent a positive signal to the property market.

China's GDP growth slowed to 7.0 percent in the first quarter of this year, and economists attributed the slowdown largely to slower investment in the property sector.

"The move will help property developers lower financing costs, and banks will also have more funds to lend to homebuyers," Yan Yuejin, a researcher with Shanghai-based E-House China R&D Institute, told the Global Times Sunday.

Banks in some cities have not fully implemented the policy announced by the central authorities on March 30 that lowers the minimum down payment requirements for second-home buyers to 40 percent, according to Yan.

In Beijing, for instance, only six banks had implemented the new down payment policies as of April 12, and the rest still insisted on a 70 percent minimum down payment requirement, according to the latest available data from financial information provider rong360.com.

But Yan said it is important for policymakers to ensure that liquidity flows into the real economy, because the recent rise in the mainland stock market has attracted some potential homebuyers to put their money into the stock market instead.

The benchmark Shanghai Composite Index has surged by about 30 percent since the beginning of this year and hit a new seven-year high on Friday.

Liu Jinjin, chief strategist at Goldman Sachs China, estimated in December that Chinese residents would channel at least 400 billion yuan ($64.5 billion) into the mainland stock market rather than the property sector in 2015, Shanghai Securities News reported on December 3.

Zhang Hongwei, research director of Shanghai-based property consultancy ToSpur, also said it would take time to see the effects of the supportive property policies.

"Inventories of unsold apartments in some second-tier and most third- and fourth-tier cities are still high, so most cities will still face downward pressure on home prices, at least in the first half of this year," Zhang told the Global Times Sunday.

The average sales revenue of China's top 20 developers fell by 15.37 percent year-on-year in the first quarter of this year, according to data from China Real Estate Information Corp.

Some property developers have launched promotion strategies to boost sales. Evergrande Group announced Wednesday that starting from Thursday buyers of its properties can change their minds and get a full refund on the purchase before they move in.

"China's property market has changed to a buyer's market from a seller's market, and developers need to improve their services to attract buyers," Zhang said.