Analysts expect additional easing moves to prop up GDP

Growth in China's industrial production, fixed-assets investment and retail sales all decelerated in July, official data showed Wednesday, raising expectations that additional easing policies will be rolled out to stabilize growth.

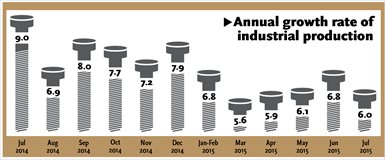

Value-added industrial output expanded 6 percent year-on-year in July, down from 6.8 percent in June, according to figures released by the National Bureau of Statistics (NBS).

Wang Baobin, a senior statistician at the NBS, attributed the slower growth to falling exports and weakening demand from the real estate sector.

Wang also noted lower production of consumer goods such as autos and cigarettes, which fell by 26.3 percent and 4.3 percent year-on-year, respectively. Retail sales grew 10.5 percent year-on-year in July, compared with 10.6 percent in June, the data showed.

A typhoon that hit some parts of the country such as East China's Zhejiang Province depressed local industrial production last month, Wang said in a statement.

Fixed-assets investment, a key driver of the nation's economy, grew by 11.2 percent in the first seven months of this year compared with a year earlier, slowing from 11.4 percent in the first half, according to the NBS.

Although the pace of investment growth eased, the structure of investment improved, with rapid growth in high-tech industries and more moderate expansion in energy-intensive sectors, Wang noted.

Real estate investment growth slid to 4.3 percent in the first seven months of this year, the slowest pace since the first quarter of 2009, but property sales showed an obvious improvement. The total floor area of transactions in the first seven months rose 6.1 percent year-on-year, up from 3.9 percent growth in the first six months, data from the NBS showed.

"Home sales in Beijing warmed up on the news that the municipal authorities will develop the eastern suburban Tongzhou district into a sub-administrative center," Yan Yuejin, research director of Shanghai-based E-house China R&D Institute, told the Global Times Wednesday. Such developments are supporting transaction volume in the capital and other first-tier cities such as Shenzhen.

However, investment overall in the sector will be constrained because of "large inventories of unsold homes in many small and medium-sized cities," Yan noted.

Li Jiao, another senior NBS statistician, said in a separate statement Wednesday that the recovery of growth in housing investment, which accounts for more than two-thirds of total property investment, will fuel the expansion of the whole sector.

"July's figures suggest that growth momentum has seen little improvement," Liu Ligang, chief China economist at ANZ Banking Corp, said in a research note Wednesday.

If the government still aims to achieve the annual fixed-assets investment growth target of 15 percent, the pace of expansion would have to reach 18.6 percent in the second half, led by infrastructure investment, Liu said.

The National Development and Reform Commission, China's top economic planner, has accelerated the approval of new infrastructure projects this year and promised to develop the Public-Private Partnership (PPP) model for such projects.

"Local governments can't afford a large number of infrastructure projects given falling revenues from land sales, so they'll have to rely on the PPP model to fund infrastructure construction," Zhang Yu, an analyst with Minsheng Securities Co, told the Global Times.

But progress has been slow for the PPP model because the authorities have not clearly explained the exit mechanism for private investment, and private investors are still waiting for more details, Zhang said Wednesday.

Analysts have voiced concerns that GDP growth will slide below 7 percent in the second half of the year and said they expected policymakers would announce additional easing measures.

"Previous stabilizing measures will not end, and there will be more policies in the second half, such as targeted monetary easing and more fiscal support for urbanization," Zhang said.

Liu forecast the central bank would further reduce banks' reserve requirement ratio by 50 basis points (bps) and cut benchmark interest rates by 25 bps during the third quarter.

"Fiscal policy will have to assume a bigger role in the second half," he noted.