E-commerce hits sales via traditional stores as shoppers' tastes shift

Global consumer goods makers are grappling with a tepid performance in the Chinese market, where they're getting squeezed between the country's booming e-commerce sector and weak demand, analysts said Wednesday.

They also said that many global giants are slow to introduce new products and may fail to recognize fast-changing tastes in China's consumer market.

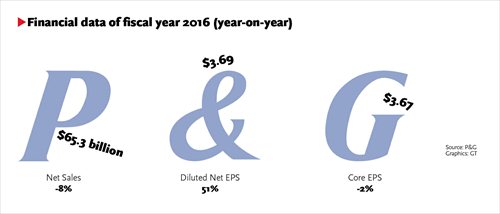

For example, US-based Procter & Gamble Co (P&G) reported on Tuesday US time that its global organic sales grew 1 percent during the fiscal year that ended on June 30, with fourth-quarter organic sales up 2 percent year-on-year.

The company also said it expects improvement for fiscal 2017, projecting an organic sales growth of about 2 percent.

Organic sales result directly from a company's existing operations.

But the picture was very different in China, where P&G's organic sales fell 5 percent year-on-year in fiscal 2016. Fourth-quarter sales were flat year-on-year, although company said there was improvement each quarter.

The company's greater China region, which includes the Chinese mainland, Hong Kong, Macao and Taiwan, accounted for 8 percent of P&G's sales, according to information from P&G's website.

P&G is not the only consumer goods company that's felt the pressure from slowing spending in China.

Hygiene products producer Kimberly-Clark Corp had to cut diaper prices in April to protect its share in the fiercely competitive Chinese market.

Personal products maker Colgate-Palmolive Co said a "sales declines in China has offset gains elsewhere in the Asia-Pacific region," a Dow Jones Newswires report said on July 28.

The report also quoted Colgate CEO Ian Cook as saying that "Colgate's online business in China has doubled year-to-date, while sales declines at brick-and-mortar retailers led to a pileup of inventory that hurt the company's results."

In late July, beverage maker Coca-Cola Co said its China sales are facing pressure amid weak consumer spending.

"Weak demand in the Chinese market is going to be the 'new normal' for every consumer products maker, as the nation's economy has not totally recovered," Chen Yuefeng, editor-in-chief of the China Chain Store magazine, told the Global Times on Wednesday.

Household income growth declined to 8.7 percent in the first quarter of 2016 from 9.4 percent a year earlier, according to a report by Boston Consulting Group (BCG) in June.

With income growth slowing, 75 percent of consumers surveyed by BCG still plan to keep their spending at the same level or higher, but that's down from 81 percent in 2015, said the report.

"Also, global brands such as P&G and Coca-Cola haven't built up support from Chinese consumers because they're too slow to introduce new products," said Chen.

The analyst take Coca-Cola as an example. As Chinese consumers rise into the middle class, they pay more attention to health issues, so Coca-Cola can't maintain its position by just redesigning its packaging, he noted.

Yan Qiang, a partner with Beijing Hejun Consulting, echoed with that opinion.

Traditional consumer product makers have many issues to deal with, such as improving their ingredients to meet consumers' expectations and diversifying their sales channels into online marketplaces, Yan told the Global Times on Wednesday.

Both Yan and Chen said that US- and EU-based consumer goods makers are "big ships" that need time to change direction.

And as these companies lose position in China, it's not so much Chinese companies that are gaining as are rivals from Japan and South Korea, the analysts said.

Citing statistics from the Korea Customs Service, domestic news portal toutiao.com reported in May that in 2015, $1.2 billion worth of cosmetics from South Korea were exported to the Chinese mainland, up 99.9 percent year-on-year.

Chen said Chinese brands that are weak in innovation and marketing still have a long way to go to erode the market share of foreign rivals.