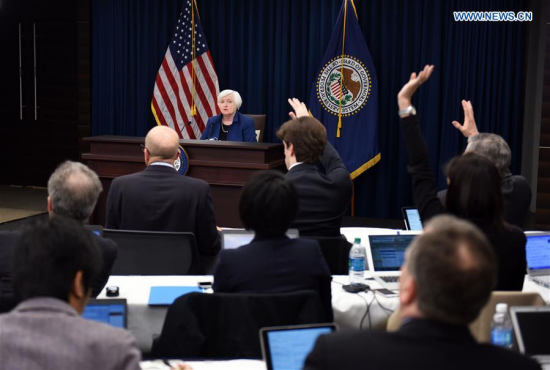

U.S. Federal Reserve Chair Janet Yellen (Rear) attends a news conference in Washington D.C., capital of the United States, on March 15, 2017. (Xinhua/Yin Bogu)

U.S. Federal Reserve on Wednesday raised interest rates for the second time in three months, shifting to a faster pace of rate hikes under the Trump administration as the job market is strengthening and inflation is rising toward its target of 2 percent.

"In view of realized and expected labor market conditions and inflation,"the Fed decided to raise the target range for the federal funds rate by 25 basis points to a range of 0.75 to 1.0 percent, the Fed's policy-making committee said in a statement released after its two-day meeting.

That was the Fed's third rate hike since the 2008 global financial crisis, which suggests that the central bank has stepped up its pace of tightening with more confidence in the strengthening of the U.S. economy.

The Fed held its benchmark short-term interest rate near zero from the end of 2008 through most of 2015, before beginning a tightening cycle in December 2015.

In a speech in Chicago earlier this month, Fed Chair Janet Yellen signaled that the pace of future rate hikes would not be as slow as once a year in 2015 and 2016, and a rate hike this month would also likely be appropriate.

"Waiting too long to scale back some of our support could potentially require us to raise rates rapidly sometime down the road, which in turn could risk disrupting financial markets and pushing the economy into recession," she said.

The Fed's updated projections on Wednesday showed that policymakers expected the federal funds rate to rise to around 1.4 percent at the end of 2017, unchanged from the estimates they made in December, implying there will be two more rate hikes later this year.

"We've seen the labor market that has healed quickly and kept generating impressive job growth," Ulrik Bie, chief economist for global macro at the Institute of International Finance (IIF), told Xinhua, adding that "the potential more inflation" generated from job growth going forward warranted more decisive actions from the Fed.

The U.S. economy added 235,000 jobs in February and the unemployment rate edged down to 4.7 percent, a level consistent with Fed's projections of full employment, according to the Labor Department.

Meantime, the core price index for personal consumption expenditure (PCE), the Fed's preferred indicator for gauging core inflation excluding food and energy, increased 1.7 percent in January from a year ago, moving toward the central bank's target of 2 percent.

"We're seeing upticks even as the PCE core inflation has been remarkably steady," Bie said, noting that "a lot of manufacturing, software and autos raised their prices at the turn of the year more than they had before" so as to test the waters to see if they had more pricing power.

The Fed's statement signaled the central bank was also more confident about inflation, noting that inflation has increased in recent quarters and moved close to its "symmetric" target of 2 percent. This means the central bank could tolerate inflation rising slightly above the target for a period of time, according to analysts.

The possibility of fiscal stimuli from the Trump administration and Congress, such as tax cuts and spending increases, has raised market speculation that the Fed may have to further accelerate the pace of rate hikes to prevent the economy from overheating. But Fed officials want to see detailed policies before re-evaluating their plans for rate hikes.

"We have not discussed in detail potential policy changes that could be put into place and we have not tried to map out what our response would be to particular policy measures," Yellen said at a press conference on Wednesday. "We have plenty of time to see what happens."

The Fed expected the U.S. economy to grow at 2.1 percent in 2017 and 2018, little changed from its December forecast.

While there was "huge policy uncertainty" in the Trump era, Bie predicted it would probably wait until the end of this year that stimuli would start to take effect. Therefore, he expected the Fed to have three rate hikes this year and four in 2018.

Bie warned that the Fed should focus on keeping longer term U.S. Treasury yields anchored while raising short-term rates.

"If they're not able to firmly anchor the longer term expectations, (U.S. Treasury) yields will go up. It will be bad for the federal budget and will be bad for household and housing market as well," he said.

The yield on 10-year U.S. Treasury notes fell to 2.5 percent on Wednesday, as the latest rate hike was well telegraphed and fully priced in the market.

The Fed also reiterated that it would continue its "gradual" tightening path towards normalization.