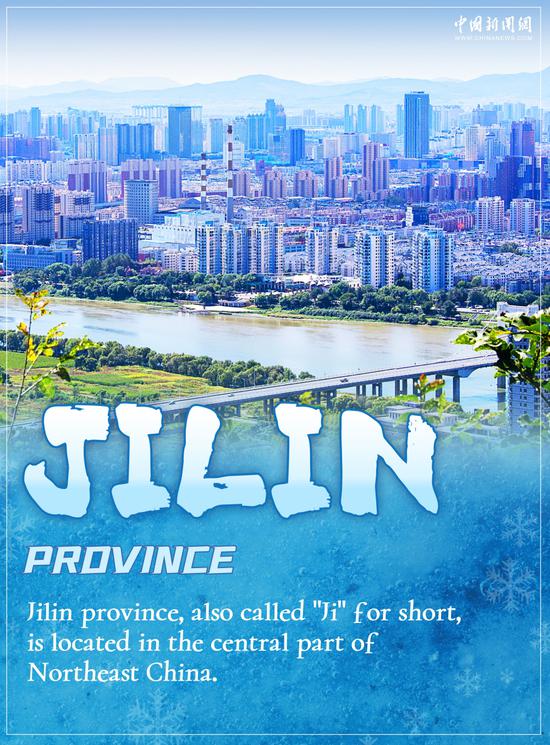

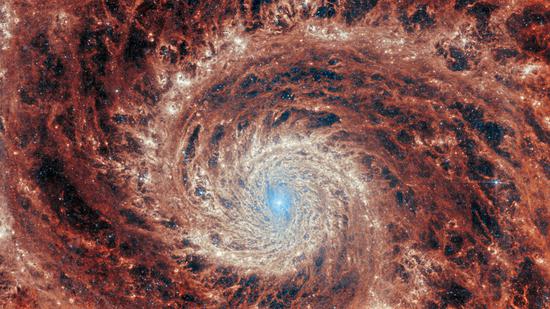

A saleswoman shows a king crab at a Hema Fresh store in Hangzhou, capital of Zhejiang province. (Photo by Long Wei/For China Daily)

Chinese supermarkets, warehouse club chains and convenience stores are increasingly relying on their own store brands to better serve consumers seeking value and affordability.

This shift indicates that store brands, which are also known as private brands, are critical to the survival and success of many brick-and-mortar retailers in China, a survey by the China Chain Store &Franchise Association revealed.

Private brands have risen steadily in recent years catering to middle-income consumers who patronize supermarkets and warehouse club chains that are membership-driven, according to the report 2023 Retailer Private-Label Best Practice and Analysis.

In 2022, private brands constituted 5 percent of total sales among the top 100 supermarkets in China, compared to 4.1 percent in 2019 and 3.2 percent in 2018, said the report.

In 2019, each retail enterprise surveyed averaged 865 products under private brands, up 32.3 percent year-on-year.

The private brands owned by the top 100 enterprises reached 40 billion yuan ($5.57 billion) in sales revenue, with each product generating 500,000 yuan in average revenue in 2019, said the report.

Private brands are expected to be the key drivers of sales at many retailers in China, said the report.

For example, Sam's Club, the high-end warehouse club chain of Walmart Inc, has seen products of its store brands account for about 30 percent of total sales.

Zhang Qing, an executive in charge of procurement at Sam's Club China, said that in the past 12 months, the company has invested nearly 1 billion yuan on private brand development to lower prices of many frequently purchased items. Development of a new product under a private brand takes between 12 months and 18 months, Zhang said.

"We dig value out of efficiency, to offer market average prices or even lower prices, with quality surpassing the market standard."

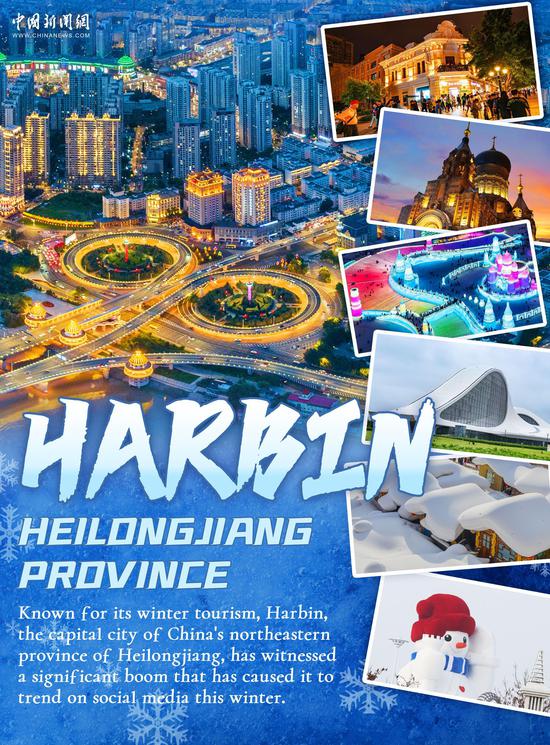

Hema, the grocery unit of Alibaba Group, promoted its own store brands throughout last year. It now boasts over 1,200 private brands. Such brands contributed 35 percent of its total sales by the end of October 2022. Hema aims for its own private brands to generate up to 50 percent of total sales by 2025.

Jason Yu, general manager of Kantar Worldpanel China, said private brands signify a distinctive strength of retailers such as Sam's Club and Hema.

"Their private brands offer not only lower prices and better quality but more consumer-oriented brand assets, boosted by innovations in technology and supply chains," Yu said.

In recent years, modern retail entities in China, including supermarkets, hypermarkets and convenience stores, have transformed into solution providers rather than being mere distribution channels, Yu said.

"By integrating supply chain resources, retailers have invested in brand building and innovation of products under private brands, allowing them to swiftly and effectively translate shopper demands into products and solutions."

The private brand market has a massive potential to grow in China, said the survey report, citing rising consumer awareness.

In 2022, nine out of 10 consumers were aware of private brands; half of them were able to pronounce the name of each store brand they recognized; and 35 percent said they made purchases in the past six months. Of the 87 percent of consumers who did not buy products sold under private labels, many said they are open-minded about store brands.

To enhance recognition of their store brands, retailers adopted various marketing strategies, including food testing, forming WeChat groups to promote new products and offering introductions from store employees.

For instance, at Sam's Club in China, 15 metric tons of samples of shrimp were consumed annually. The company has also set up Sam's Kitchen where professional chefs provide recipes and cooking tips for food products bearing store brands.

However, a major challenge is the lack of innovation, which means others could easily copy many private labels, said Yu of Kantar.

Inadequate focus on private labels also hampers consumer awareness of the real value of these products. Enhancing the distinctiveness and perceived value of private labels is crucial for the evolution of retailers, he said.

京公網安備 11010202009201號

京公網安備 11010202009201號