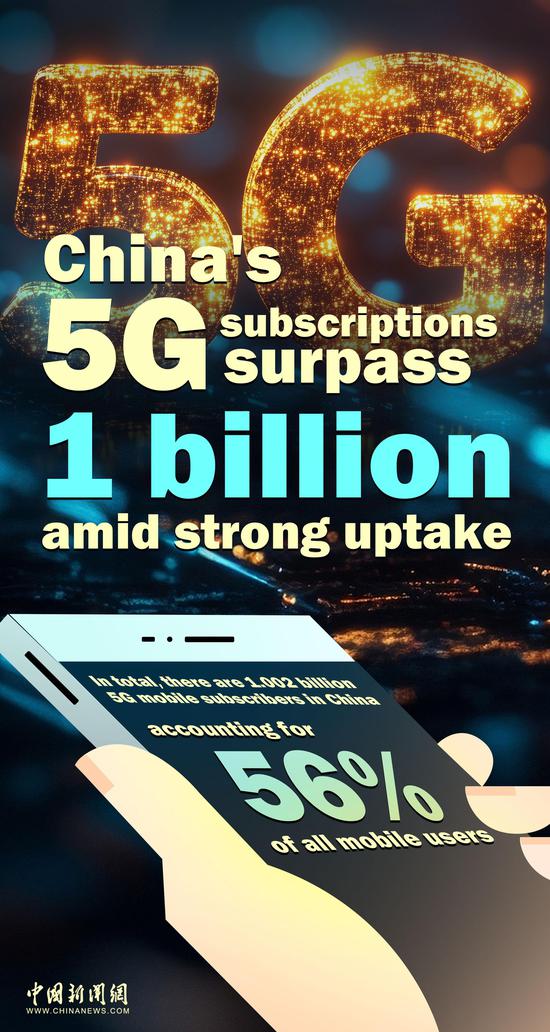

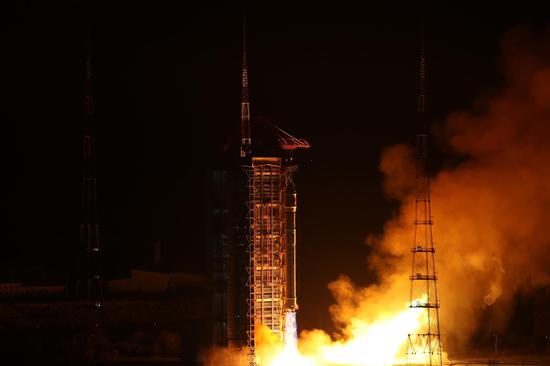

The booth of Tongwei Co Ltd during an expo in Shanghai. (Photo/China Daily)

Two major photovoltaic companies vowed on Tuesday to cut production volume as the industry navigates through supply-demand imbalances and excess outdated capacity, leading to intense price-centered competition.

Experts deem output management and technological innovation as crucial for companies to forge unique competitive advantages in the face of intense price competition in sectors like solar power. They also anticipate the rollout of a broader set of financial tools to alleviate financial pressure on firms resulting from their investments in innovation.

The remarks came after addressing problems stemming from hyper-competition was discussed for the first time at the recent Central Economic Work Conference as one of the key priorities for the upcoming year.

In answering the government's call, solar power firms Tongwei Co Ltd and Daqo Energy announced on Tuesday they would scale back output volume on certain production lines.

Four high-purity crystalline silicon production companies owned by Tongwei will undergo gradual output cuts to reduce operational losses and improve overall profitability. Daqo, on the other hand, will implement controlled production reductions on polysilicon production lines in the Xinjiang Uygur autonomous region and the Inner Mongolia autonomous region.

As for reasons behind the market challenge, experts highlighted that macroeconomic fluctuations, inadequate domestic demand and escalating trade tensions have burdened companies with inventory pressures, prompting businesses to engage in irrational pricing strategies to bolster their market presence. Meanwhile, certain less capable firms continue to expand to vie for land and resources in order to exploit government incentives for emerging industries, further exacerbating market imbalance.

"Manufacturers are struggling with a dilemma — they can sell below cost and burn more cash, or they can reduce utilization and increase per-unit cost. This situation is likely to persist for at least a year," said Tan Youru, a solar analyst at research provider BloombergNEF.

"We estimate that inventory remains significant at 300,000 to 350,000 metric tons, which is sufficient to support the production of over 150 gigawatts of modules — at least three months of market demand. Once prices rise enough to restore profitability, many idle factories are likely to be reactivated, suppressing prospects of any material price rebound," Tan said.

The China Photovoltaic Industry Association said production volumes of key components such as polysilicon, silicon wafers, cells and modules have seen significant year-on-year growth exceeding 20 percent in the first 10 months. However, prices for these components have sharply declined, with polysilicon dropping by over 35 percent, wafers by more than 45 percent, and cells and modules by over 25 percent.

However, the association said the situation is improving, as since mid-October, procurement prices for PV components from central State-owned enterprises have leveled off, with a few projects seeing minor upticks. Overall, prices across the industry chain have exhibited a recent trend of stability.

Wei Jigang, deputy director-general at the Institute for Market Economy, Development Research Center of the State Council, highlighted innovation as key to tackling supply-demand imbalances and surplus outdated capacity.

Yet, the drive for innovation in enterprises imposes notable cost pressures, requiring policy backing to boost innovation endeavors while ensuring operational stability.

Yu Xiang, CITIC Securities' chief policy research analyst, foresees a broad expansion in fiscal support quotas for the real economy in 2025, potentially channeling funds toward industrial advancements, new infrastructure and high-end manufacturing growth.

京公網安備 11010202009201號

京公網安備 11010202009201號