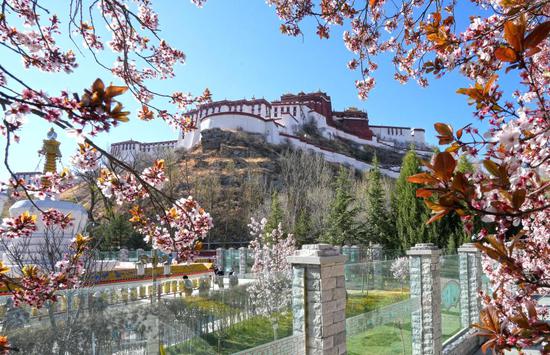

A view of a Li-Ning store in Shanghai in February. (CHINA DAILY)

Leading global sportswear brands are capitalizing on the substantial growth potential of the Chinese market, which is driving their expansion and investment strategies.

Among these brands, Lululemon Athletica Inc has emerged as a standout performer, reporting impressive financial results for the fourth quarter and fiscal year ending Feb 2. The company's growth trajectory in China has been a key contributor to its performance.

In the Chinese market, Lululemon recorded an impressive 46 percent year-on-year surge in net revenue for the fourth quarter, while full-year revenue grew 41 percent compared to 2023.

The company has been proactive in expanding its presence, culminating in the operation of 151 stores in China by the end of the fiscal year. In 2025, the company plans to see revenue growth in China of between 25 percent and 30 percent.

On a global scale, Lululemon's net revenue increased by 13 percent, reaching $3.6 billion in the fourth quarter. International sales played a crucial role, climbing by an impressive 38 percent, while revenue from the US market showed a more modest increase of 7 percent. For the entire fiscal year, Lululemon reported a 10 percent net revenue growth year-on-year, totaling $10.6 billion.

This growth was largely driven by a 34 percent increase in international sales and a 4 percent rise in the US market, with gross profit for the year growing 12 percent to $6.3 billion on a yearly basis.

Calvin McDonald, CEO of Lululemon, attributed these results to a mix of product innovation and heightened brand engagement.

"Our fourth quarter results exceeded expectations as we continued to introduce more newness and innovation into our product assortment," he said, highlighting the company's commitment to evolving its offerings to meet consumer demands.

In line with its ambitious growth strategy, Lululemon has actively pursued store expansion, opening 18 net new locations in the fourth quarter and an additional 56 stores throughout 2024. This growth brings the total number of Lululemon stores globally to 767.

The company has set its sights on making China its second-largest market globally by 2026.

Meghan Frank, chief financial officer, underscored the company's dedication to increasing brand awareness in international markets. Currently, unaided brand recognition in China is in the mid to high teens, compared to the 30s in the US.

"We expect to open 40 to 45 net new company-operated stores in 2025 and complete about 40 optimizations. We expect overall square footage growth of about 10 percent. Our new store openings in 2025 will include about 10 to 15 stores in the US market, with the rest of our openings planned in our international markets, the majority of which will be in China," Frank said.

To enhance its presence in China, Lululemon is leveraging various marketing initiatives, including high-profile events like the Formula 1 races in Shanghai, which feature brand ambassador and star F1 driver Lewis Hamilton. The three-day racing event attracted over 220,000 spectators, surpassing last year's attendance.

Customers shop at an Arc'teryx store in Hangzhou, Zhejiang province, in January 2024. LONG WEI/FOR CHINA DAILY

Additionally, local engagement initiatives such as the Sweat Games and World Mental Health Day have allowed Lululemon to enhance relations with local communities.

Product innovation has been a crucial factor behind Lululemon's strong performance in the fourth quarter, particularly in categories such as outerwear and sporty accessories.

McDonald said: "Our unique approach to innovation is grounded in creating technical apparel with diverse and adaptable use cases. This continual introduction of newness into our product lineup fosters guest loyalty and drives repeat purchases."

Nike has also reported its fiscal 2025 third-quarter results for the period ending Feb 28, highlighting its strategic transformation within the highly competitive Chinese market. Nike China generated $1.7 billion in revenue during the quarter.

However, Nike has faced challenges due to ongoing promotional activities that have impacted both revenue and gross margins, particularly within digital channels. In response, the company is taking proactive steps to optimize and clean up inventory to prioritize the long-term health of its retail partnerships.

Elliott Hill, Nike's president and CEO, acknowledged the need for urgency.

"Sport is growing in China, and we must accelerate our pace. Our brands remain strong, but our actions to energize the marketplace will take time. We remain focused on creating brand distinction through sport, product innovation and hyper-local products. China specifically is where we're being the most proactive and cleaning up the marketplace and we'll get back to inspiring the Chinese consumers in a more meaningful way," Hill said.

Dong Wei, chairman and CEO of Nike Greater China and Global CEO of All Conditions Gear, highlighted the company's focus on inventory management, operational efficiency and consumer-driven innovation, expressing strong confidence in Nike's long-term development in China.

Nike's product innovations continue to resonate with Chinese consumers, as evidenced by strong demand for the Pegasus Premium and Vomero 18 running shoes, coupled with notable growth in Kobe Protro basketball sneakers during the "Year of the Mamba" campaign in 2025. Additionally, locally designed products, such as the Spring Festival collection, have garnered significant market attention, according to the company.

To further expand its reach, Nike is actively engaging with female consumers in China. The recently relaunched Nike Air Superfly, a women-focused running-inspired lifestyle shoe, has gained traction and popularity among both sports enthusiasts and fashion-forward consumers.

Meanwhile, German sportswear brand Adidas posted results in March with double-digit growth in 2024, with a 12 percent increase on a currency-neutral basis and improved operating profit by over 1 billion euros ($1.08 billion), reaching 1.337 billion euros. The Chinese market contributed to this success, achieving 10 percent growth for the year. In the fourth quarter, Adidas experienced an accelerated top-line growth in China, jumping to 16 percent.

Meanwhile, Fujian province-based Anta Sports Products Ltd reported strong year-end performance, with revenue rising to 70.83 billion yuan ($9.74 billion), representing a 13.6 percent year-on-year increase for the fiscal year ending Dec 31. The company's profit from operations climbed 8 percent, reaching 16.60 billion yuan. Euromonitor International has recognized Anta as a leader in the Chinese sportswear market, capturing a market share of 23 percent. This positions Anta ahead of its competitors, including Nike (20.7 percent), Li-Ning (9.4 percent) and Adidas at 8.7 percent.

Anta's results can be attributed to strong growth across all brand segments. The flagship Anta brand reported a 10.6 percent revenue increase year-on-year, totaling 33.52 billion yuan, while operating profits for this segment rose 4.5 percent to 7.04 billion yuan. The Fila brand also performed well, with a revenue up 6.1 percent at 26.63 billion yuan. Additionally, revenue from the company's other brands surged 53.7 percent to 10.68 billion yuan, with operating profits for these brands jumping 61.7 percent to reach 3.05 billion yuan.

E-commerce continues to play a vital role in Anta's growth strategy, with revenue in this segment rising 21.8 percent year-over-year. E-commerce now accounts for 35.1 percent of the group's overall revenue, reflecting a significant shift in consumer purchasing habits toward digital platforms. The company plans to expand its retail presence further, aiming to operate 6,900 to 7,000 stores by the end of 2025.

京公網安備 11010202009201號

京公網安備 11010202009201號