Since beginning of year, China has seen trend for time over demand deposits

The recent reduction in bank deposit rates is conducive to maintaining reasonable profit margins among banks and strengthening their capacity to generate capital through profits. The moves can also help promote consumption and investment and increase economic vitality, financial analysts said.

China's six largest State-owned commercial banks by assets recently cut their demand deposit interest rate by 5 basis points to 0.2 percent. The banks also lowered their two-year deposit rate by 10 basis points to 2.05 percent, three-year deposit rate by 15 basis points to 2.45 percent, and five-year deposit rate by 15 basis points to 2.5 percent.

Following these large lenders, many national joint-stock commercial banks, city and rural commercial banks, and even some village and township banks also lowered deposit rates. For example, Shanxi Bank, a regional commercial lender in Shanxi province, recently cut its three-year deposit rate by 15 basis points to 3.05 percent and five-year deposit rate by 20 basis points to 3.1 percent.

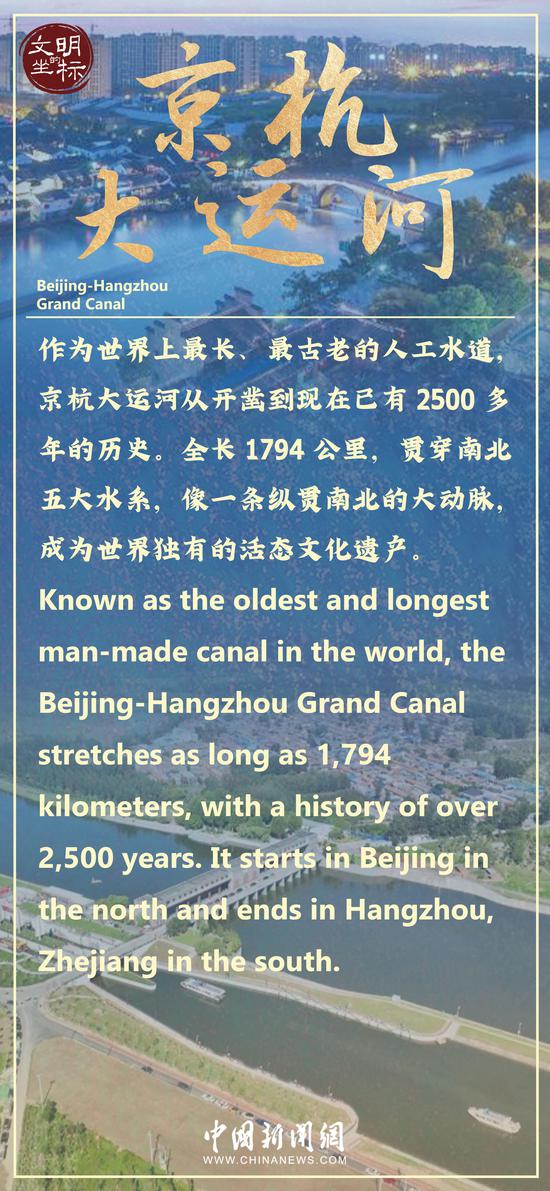

Since the beginning of this year, China has seen a trend for demand deposits turning into time deposits, especially long-term deposits.

As of the end of May, domestic deposits among households amounted to 130.45 trillion yuan ($18.26 trillion). More than 71 percent of the total were time and other deposits, which reached 93.05 trillion yuan. Domestic deposits by nonfinancial enterprises hit 80.66 trillion yuan, to which time and other deposits contributed nearly 68 percent, said the People's Bank of China, the country's central bank.

Banking analysts with Zhongtai Securities said a combination of multiple factors, including sluggish domestic consumption growth, declining net interest margins (NIM) among lenders and a continuation of the trend for demand deposits becoming time deposits, led to the latest round of deposit rate cuts.

China's banking sector has faced slower profit growth since the beginning of this year. In the first quarter, net profit of commercial banks totaled 667.9 billion yuan, up 1.3 percent year-on-year. The growth rate dropped by 6.1 percentage points from the same period last year, said the National Financial Regulatory Administration.

In 2022, the net interest margin of commercial banks decreased quarter by quarter. The narrowing of NIM and the slowdown in banks' net profit growth are closely related to continuous fee reductions and lending rate cuts in China's banking sector. They will harm the sustainability of lowering financing costs for the real economy and affect banks' capacity to replenish capital, said Dong Ximiao, chief researcher at Merchants Union Consumer Finance Co.

"Currently, it is still necessary to delay the stress of shrinking NIM in the banking sector and sustain the momentum of steady development by cutting deposit rates and thus lowering banks' borrowing costs," Dong said.

The purpose of adjusting deposit rates is to help the rates return to normal and reasonable levels, ensure NIM remains relatively stable and reasonable, and also create conditions for further lowering financing costs for the real economy, said Zeng Gang, director of the Shanghai Institution for Finance &Development.

At present, China's economic growth still faces some challenges and demand for capital is relatively insufficient. Therefore, the country faces certain downward pressure in terms of interest rates, and there are calls for further rate cuts to promote more economic development, Zeng said.

On Thursday, the People's Bank of China lowered the rate on 237 billion yuan of one-year medium-term lending facility loans to some financial institutions by 10 basis points to 2.65 percent for the first time in 10 months.

During his visit to Shanghai earlier this month, Yi Gang, governor of the PBOC, said the central bank will comprehensively utilize various monetary policy tools, maintain reasonable and ample liquidity, ensure moderate and steady growth of money supply and credit, and promote the stability and gradual reduction of comprehensive financing costs for the real economy.

京公網安備 11010202009201號

京公網安備 11010202009201號