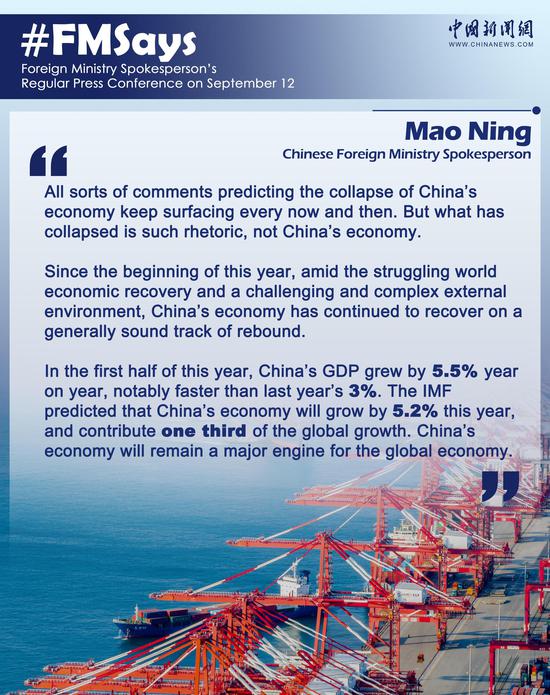

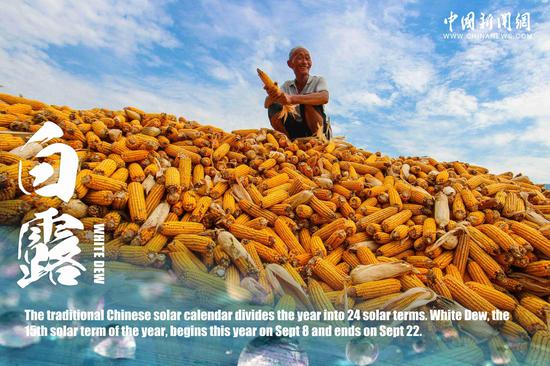

Prospective homebuyers check out information about a residential complex in Chongqing in August. (CHINA DAILY)

Recently seen upswing supported by latest raft of favorable policies targeting sluggish sales of residential units

Just two weeks after Beijing launched policy incentives to warm up the property market, real estate agent Wu Lei felt the change.

Potential clients who usually brushed him aside started flooding his phone with inquiries, while in the past, engaging in a conversation longer than three sentences had been a challenge.

On the evening of Sept 1, both Beijing and Shanghai adopted a policy to recognize households with mortgage records but no local property ownership as first-time homebuyers, making them eligible for favorable down payments and lower mortgage rates.

By then, all four traditional first-tier cities — including Guangzhou and Shenzhen in Guangdong province — had adopted such a policy.

"I was called back to work that night after regular hours. Some salespeople were even instructed not to close the shop. Since then, my phone has turned into a 24/7 hotline as clients bombard me with calls and messages on how recent policies could benefit their purchases," said Wu, who works in Beijing at real estate agency 5i5j.

So far, more than 20 cities, including the four tier-one cities, have adopted the new policy on identifying first-time homebuyers. Various regions have also introduced a combination of encouraging policies, such as selling-old-for-new schemes, tax subsidies and reduced mortgage interest rates.

According to realty market analysis provider China Index Holdings, after the policy implementation, since late August, nationwide willingness to purchase real estate has increased by 15 percentage points, with significant improvements seen in Beijing, Shanghai, Guangzhou and Shenzhen, where the first two saw increases of around 20 percentage points each.

In the past week, Beijing witnessed a 16.9 percent weekly increase in new home sales area to 103,000 square meters. Shenzhen saw a 3.8 percent weekly rise to 38,000 sq m during the same period, according to China Index.

Experts said recent policies are buoying up market sentiment and helping drive transactions for both new and pre-owned homes, which in turn supports the troubled real estate sector to recover and contributes to the overall economic rebound.

"Various favorable policies have been successively introduced of late, like reducing down payment ratios, lowering mortgage interest rates and adjusting eligibility criteria for first-time homebuyers. These measures are very conducive to reducing the costs associated with buying homes and increasing enthusiasm for buying residential property in the future," said Yan Yuejin, research director of Shanghai-based E-House China Research and Development Institution.

"China's real estate market is showing some positive signs of a steady recovery. This may help boost sales during the traditional peak period of September and October," Yan said.

Moreover, Chinese lawmakers will not consider levying property tax, which means, Yan said, the tax, possibly dampening the market sentiment at least temporarily, will not appear in the plan for legislation for at least three years.

Property taxes weren't mentioned in the recently released legislative plan by the National People's Congress Standing Committee on Sept 7.

This, together with the recent slew of stimulus policies, will help increase property deals and stabilize the real estate market, which will provide a boost to the national economy, he said.

"An increase in property sales will also trigger a substantial influx of funds for real estate developers, which will have a positive impact on their business operations. They are expected to yield improved financial performances," Yan said.

Hong Kong-listed developer Sunac China Holdings saw the transaction volume in its real estate project One Sunac Opus, located in Beijing's Chaoyang district, reach 5.62 billion yuan ($773 million) with the sale of 169 homes on Sept 3, the opening day. The homes were sold for more than 30 million yuan each, with per-house areas ranging from 215-291 sq m.

Prospective homebuyers visit a demo apartment in Huizhou, Guangdong province, in August. ZHOU NAN/FOR CHINA DAILY

The next day, Sunac's shares saw a 34 percent jump in Hong Kong, leading gains in the sector. The company saw a total of over 110-percent growth between Sept 4-6. Some other real estate developers, including Country Garden, all experienced share price increases last week.

"New home transactions have been unexpectedly brisk. Homebuyers I serve are mostly young couples expecting to purchase their first home in Beijing and second-time buyers looking to improve their living conditions," said Li Chao. She currently manages sales of a new housing project located in northeastern Beijing.

Pre-owned home sales also saw a rise in major cities. Around 5,000 pre-owned homes were sold over the past week in Beijing, nearly half of August's total, according to realty agency Centaline Property.

The situation in Shanghai is quite similar, as families are keen to look at available properties that allow children to attend good schools.

Yang Jiarong, a manager at a Shanghai office of Sinyi Realty, said, "We have seen a 20 percent to 30 percent increase in appointments made by prospective homebuyers. There is also an increase in transactions."

Coming from a remote county in Shaanxi province, Yang has been working at Sinyi for 12 years, experiencing the highs and lows of Shanghai's real estate market for over a decade.

"With the introduction of the new policies, many clients, whether they are returning customers or new referrals, are seizing this opportunity to quickly sell their properties or change to new ones. Every day, we remain quite busy," Yang said.

Entering the realty market at a very rough period — in 2011 — Yang said the market was very weak at the time, with a number of retailers closed and many agents failing to make even one transaction in a month. But she held out with long-term confidence for market prospects. In return, working in the sector has helped her support a family with two children. This year, she managed to get the hukou, an official household registration, in Shanghai.

"The opportunities are always there. I never quit learning, or sharing experiences and up-to-date policies on property purchases. Even during COVID-19 and the past two years when market performance wasn't that good, I managed to land pretty decent deals," she said.

"Regardless of how Shanghai's real estate market evolves, it consistently records a monthly transaction volume of at least 10,000 units, maintaining its position as the top city in terms of transactions among the four traditional first-tier cities. From the government's perspective, it continues to ensure the stability of the real estate sector. Therefore, relatively speaking, I believe that opportunities have always been present," she said.

Despite an increase in appointments to visit homes for sale, Wu of 5i5j said his manager had cautioned sales staff to avoid pressuring customers into buying homes by using words like "sales frenzy", or exaggerating the current situation.

"The realty market's recovery is gradually picking up. We want a stable market and sustainable development instead of drastic fluctuations," Wu said.

"The real estate policies have a stimulative effect on market recovery, but they won't lead to full recovery overnight. It will take time for their true impact to become evident," Yan said.

Wang Yingin Shanghai and Wang Zhuoqiongin Beijing contributed to this story.

京公網(wǎng)安備 11010202009201號

京公網(wǎng)安備 11010202009201號