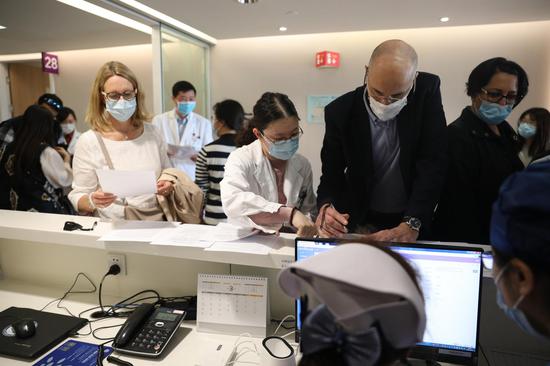

An investor checks stock prices at a brokerage in Fuyang, Anhui province. (Photo by Lu Qijian/For China Daily)

The Chinese mainland stock market remains "very attractive" for global investors over the long term, although a stretched valuation has magnified the volatility of A shares, a leading investment company said.

Wang Qian, Asia-Pacific chief economist with the U.S.-based Vanguard Investment Strategy Group and global head of Vanguard Capital Markets Model, said the forecast is based on growth outlook and diversification benefits of the A-share market.

Wang's observations come at a time when the A-share market has been on a rollercoaster ride. After the benchmark CSI 300 index rose by 13.8 percent since the beginning of the year and peaked at an all-time high of 5930.91 points on Feb 18, the index had shed all the year-to-date gains by Friday's close of 5161.56 points, according to market tracker Wind Info.

According to market analysts, the rollback is largely due to investor concerns about macro policy shifts and worsening geopolitical tensions. The CSI 300 index rose by 27.2 percent to 5211.29 points last year, outrunning most of the major overseas stock indexes and pushing its valuation level high.

A recent Vanguard paper has found that the starting level of valuation, together with volatility in economic growth, explains a considerable share of long-term stock market return, meaning that a stretched A-share valuation will weigh on its return outlook, Wang told China Daily.

Due to the higher valuation, there will be a weakness in the attractiveness of A shares on a yearly basis, she said, adding that a synchronized global recovery could also impair A shares' short-term advantage.

"However, I think from a strategic, long-term perspective, Chinese assets actually remain very attractive for global investors," Wang said, adding that she expects strategic investors to continue adding Chinese stocks and bonds into their portfolios.

"This market is just too big to ignore," Wang said. The A-share market, already the world's second-largest equity market, will continue to grow along with the economy and even outpace economic growth as China continues to increase the share of direct financing, or equity and bond financing, in the financial system.

Even though a higher valuation has lowered return prospects, A shares are still expected to offer long-term annualized market returns of about 6.3 percent, modestly higher than the global level, Wang said, let alone the valuable diversification benefit China provides in a global portfolio.

Foreign investors' interest in A shares has withstood the first-quarter volatility as net inflows into Shanghai and Shenzhen via northbound links with Hong Kong during the period remained positive at 99.9 billion yuan ($15.2 billion), slightly slowing from 115.2 billion yuan in the fourth quarter of last year, according to Wind Info.

A March report released by Global-Data, a London-based data and analytics company also indicated that China's onshore capital markets have emerged as a safe haven for overseas high net worth investors.

Returns of the A-share market this year will mainly derive from recovering earnings of listed firms, especially those that have lagged in recovery but are set to catch up, such as some of the consumer and services sectors, Wang said.

A normalizing consumer spending growth will go together with resilient exports, picking up manufacturing investment and a low comparison base to drive a projected 9 percent annual economic growth for China this year, versus 2.3 percent for 2020, she said.

Valuation, meanwhile, has a limited room for further expansion and even faces downside risks this year as policy normalization is underway that will gradually wean the economy off an ultraloose liquidity condition, Wang said.

While the rising government bond yields in the United States have become a hotly discussed factor that could weigh on A-share outlook, the impact should be limited, Wang said.