Mortgage rate lower, sending positive signals to struggling property firms

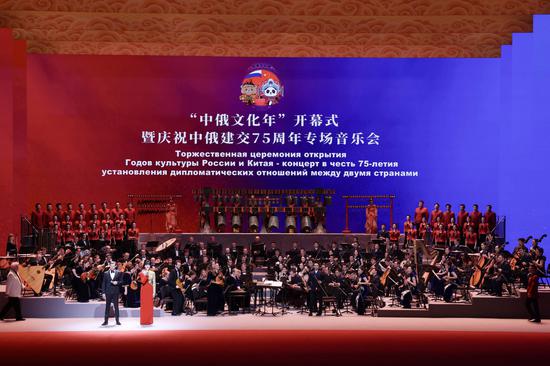

Potential homebuyers ask queries on housing projects at a real estate agency in Beijing in March. [JIANG QIMING/CHINA NEWS SERVICE]

China's real estate market is expected to become fully stabilized in the second half of 2024, ending a three-year adjustment period, if the latest rounds of highly supportive policy measures are well implemented to boost homebuyer confidence and ease liquidity stress among developers, experts said on Friday.

They also expect restrictions on housing purchases and loans will be gradually phased out, while more policy measures may be needed to reinforce market expectations and accelerate recovery of the sector.

Chinese authorities on Friday eased mortgage rules and vowed to fight the tough battle of dealing with the risk of unfinished commercial housing. They also asked to promote presold home deliveries, reduce housing inventories and improve financing for developers. Share prices of developers on A-share markets subsequently surged.

On Friday, the country removed commercial mortgage rate minimums for first and second homes nationwide, and lowered minimum down payment ratios for first and second homes, respectively, to 15 percent and 25 percent.

It also announced the establishment of a 300 billion yuan ($41.51 billion) relending facility for affordable housing to encourage and guide financial institutions to support local State-owned enterprises in acquiring unsold completed commercial housing at appropriate prices — to be used as either sale-oriented or rental-oriented affordable housing — in accordance with market-oriented and law-based principles.

Starting from Saturday, it will reduce interest rates for personal housing provident fund loans by 0.25 percentage points.

In another development, at a news conference in Beijing on Friday, it was announced that new measures will be introduced to support local governments to recall or buy back unused residential land parcels held by property developers to help relieve their financial stress. Governments in cities with excess home inventories can organize local State-owned enterprises to buy unsold houses at appropriate prices and convert them into affordable housing, it said.

"Centering on lowering mortgage rates, loosening home purchase restrictions and encouraging local government purchases of unsold houses to convert them into affordable housing, the latest rounds of policy measures will provide strong support for both supply and demand sides in the real estate sector," said Wang Qing, chief macroeconomic analyst at Golden Credit Rating International.

"This will promote presold home delivery and alter the ongoing trend of a substantial year-on-year decline in completed areas of commercial properties since the start of the year. Additionally, it will effectively reduce inventory pressure, alleviate the financial strain on developers and better manage default risks," Wang said.

The interest rate for new mortgages extended to residents was 3.69 percent by the end of March, said the People's Bank of China, the country's central bank. The actual mortgage rate, on an upward trend since 2021, was believed to be among the highest in history given the currently low inflation levels, which was a key factor underlying the downward pressure in the property market despite supportive policies in place, Wang said.

"That means there is considerable policy room for supporting the property market, and if these adjustments are made in a timely manner, the sector could stand a good chance of stabilizing," he added.

Yan Yuejin, director of the Shanghai-based E-house China Research and Development Institution, said the new development also signaled that efforts to optimize land utilization across various places are set to accelerate, which will help real estate developers convert their land inventory into cash and thus alleviate their liquidity stress.

"In the past, policies to improve land use typically focused on minimizing land idleness and waste. This time, however, it is clear that the emphasis has shifted toward primarily alleviating the challenges faced by real estate enterprises and reducing their debt burdens," Yan said.

Wang Xingping, senior analyst of corporates at rating agency Fitch Bohua, said the new policy measures were "unprecedently supportive" of the property industry.

Yet the prolonged property market downturn, in tandem with downward macroeconomic pressure, has severely dampened market confidence, Wang said, adding, "There's still a high possibility for more supportive policies aimed at stimulating sales in the short run, which will help to constrain the decline in property sales."

Chinese cities reported deeper home price drops in April both in year-on-year and month-on-month terms, which indicated that the property market remains in a process of adjustment, said Wang Zhonghua, a statistician with the National Bureau of Statistics' urban division.

Price declines broadened month-on-month in all the tier-three cities for both new homes and pre-owned properties, said Wang of the NBS.

Lu Ting, chief China economist at Nomura, said the task of ensuring the delivery of presold homes holds the key to halting the "downward spiral" facing China's property market.

Households' unwillingness to buy properties has intensified real estate developers' liquidity stress, which, in turn, further impeded home delivery and discouraged home buying, Lu said. "It is therefore sensible for the central government to establish a fund specifically dedicated to guaranteeing housing delivery."

Liu Zizhengcontributed to this story.

京公網安備 11010202009201號

京公網安備 11010202009201號