China is set to intensify its efforts to attract and harness foreign investment, with a specific focus on removing market access restrictions in the manufacturing industry and introducing pilot measures to expand the opening-up of the service sector.

China's increasing economic growth, large consumer base and technological advancements are strong incentives for foreign businesses seeking opportunities to expand their market share, experts and executives said at a recent meeting, while cautioning that the global landscape presents a complex set of circumstances that hinders the inflow of foreign capital into China.

As the world's second-largest economy gears up for the second half of the year, the State Council, China's Cabinet, reiterated in late June the pivotal role of foreign-invested enterprises in shaping the country's new development paradigm and announced a series of initiatives to stabilize foreign investment in the pipeline.

In the first five months of the year, foreign direct investment on the Chinese mainland, in actual use, totaled 412.51 billion yuan ($56.77 billion), which was 28.2 percent lower than that of the same period last year, data from the Ministry of Commerce showed.

While the quantity of foreign-invested projects has risen, the decline in the actual utilization of foreign capital indicates a shift toward lighter asset projects and a greater presence of small and medium-sized projects, said Bai Ming, a researcher at the Chinese Academy of International Trade and Economic Cooperation.

This decrease in the proportion of large-scale projects poses a significant challenge for China's economic landscape, Bai said, stressing that the decrease in foreign investment inflows into China is not an isolated phenomenon but is part of a larger global trend.

The flow of foreign direct investment globally saw a steep 18 percent decline last year when a few European conduit economies, which often act as intermediaries for FDI destined for other nations, were excluded, according to data from the United Nations Conference on Trade and Development.

In addition, global industrial restructuring, geopolitical rivalries and competition from developing countries have collectively contributed to the decline in China's foreign investment inflow, as shown by a report from the China Macroeconomy Forum in late May.

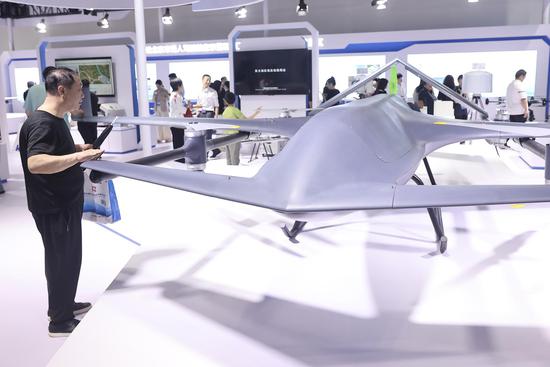

Foreign investors in China are increasingly focusing their investments on the manufacturing and service sectors. Notably, foreign-funded enterprises are gradually withdrawing from traditional manufacturing fields and shifting toward high-tech and high-profit areas, the report said.

In the first five months of this year, China's manufacturing sector attracted 117.1 billion yuan in actual foreign investment, up 2.8 percentage points year-on-year, with high-tech manufacturing accounting for 50.41 billion yuan, a 2.7 percentage point increase year-on-year, according to the ministry.

Taming restrictions

In the free trade pilot zones, which have been at the forefront of China's economic reforms and liberalization efforts, the negative list for foreign investment in the manufacturing sector has been eliminated, said Cui Fan, a professor at the University of International Business and Economics.

Efforts to revise the national version of the negative list and remove restrictions on foreign investment in the manufacturing sector across the entire country are underway, Cui added.

Following the complete removal of market access restrictions on foreign investment in the manufacturing sector, the focus of China's efforts has now shifted toward opening up sectors such as telecommunications, healthcare and other service industries, experts said.

This move presents new opportunities for foreign investors looking to enter high-demand areas such as education, healthcare and elderly care, where the Chinese market shows tremendous growth potential, said Jin Ruiting, a researcher at the Chinese Academy of Macroeconomic Research under the National Development and Reform Commission.

Allianz Global Investors, owned by German insurer Allianz, secured a 2 percent stake in Chinese national pension insurer Guomin Pension& Insurance Co in late June to expand its presence in China's burgeoning private pension sector, which is considered lucrative due to an aging demographic.

In May, Belgian insurer Ageas sealed a deal to invest around 1.07 billion yuan to acquire a stake in Taiping Pension, a subsidiary of China Taiping Insurance Holdings, in a move to tap the Chinese pension market's potential by capitalizing on the increasing demand for personal pension products in China.

京公網安備 11010202009201號

京公網安備 11010202009201號