Financial infrastructure in China should be further improved to facilitate the use of the renminbi in trade in services as certain services are playing a bigger role in China's overall foreign trade, experts said on Tuesday.

They made the comments after the State Council, the country's Cabinet, said in a circular on Monday that the nation will expand the cross-border use of the renminbi in trade in services.

This is part of the efforts to optimize cross-border capital flows, which are aimed at establishing and improving a negative list management system for cross-border trade in services.

Yuan-denominated cross-border financing and refinancing for trade purposes will be further supported, according to the State Council's document.

He Qing, a professor at the School of Finance, which is part of Renmin University of China, said cross-border use of the RMB for financing purposes is still on a small scale at present. While the RMB interest rate is now lower than that of other major currencies, more companies may consider RMB financing thanks to its lower costs.

But the current supply of cross-border RMB financial tools and products cannot meet companies' diversified financing demand. More room for development can be expected in this regard by making the most of the time window of interest rate gaps, he said.

Meanwhile, foreign exchange management measures should be completed, exploring hierarchical management based on companies' credit. In this way, foreign exchange services will be accessed more easily for trade in services and outbound investment in the services sector, according to the State Council's circular.

The value of China's trade in services jumped 14 percent year-on-year to 3.6 trillion yuan ($505.5 billion) in the first half, said the Ministry of Commerce in early August.

While trade in travel-related services spiked 47.7 percent year-on-year to 961.7 billion yuan in the first six months, contributing to the overall surge in trade in services, trade in knowledge-intensive services like intellectual property royalties and entertainment services rose 3.7 percent to top 1.4 trillion yuan.

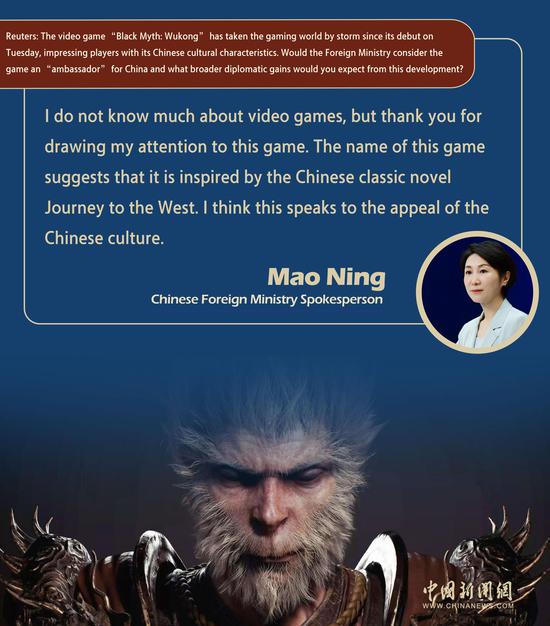

According to Tang Wenhong, assistant minister of commerce, the transformation toward trade in services featuring digitalization, smart technologies and green transition has been accelerating. New technologies and novel business models have emerged quickly in trade in services, including digital games, short videos and online literature.

Banks' foreign exchange services should improve and change accordingly, said Liu Bin, head of the Current Account Management Department at the State Administration of Foreign Exchange.

In response to the new trends and business models in trade, banks should be given more autonomy to review businesses, evolving from case-by-case review to due diligence and business rationality assessment. Banks are encouraged to come up with innovative review methods to further optimize their business procedures. Therefore, companies can be granted more convenient foreign exchange services, said Liu.

Wang Jing, a researcher from the BOC Research Institute, said banks should further integrate their financial products and services with the actual scenarios in foreign trade. They should come up with more diversified and even tailor-made solutions to better address the needs of companies conducting foreign trade, she said.

Zhang Ming, deputy director of the Institute of Finance &Banking, which is part of the Chinese Academy of Social Sciences, suggested that construction of the infrastructure for the RMB's cross-border use should be completed at a faster pace to facilitate trade.

To that end, the Cross-border Interbank Payment System, which was launched in 2015 to integrate channels for RMB cross-border payments and settlements, should be given more play. The number of direct CIPS users should be increased, with the system's efficiency further improved, said Zhang.

CIPS can also team up with other cross-border clearing systems such as INSTEX in Europe so that a safer and more inclusive cross-border payment and clearing network can be built, which will also be conducive to the further internationalization of the RMB, he said.

京公網(wǎng)安備 11010202009201號(hào)

京公網(wǎng)安備 11010202009201號(hào)